How GSTR-2B Helps in Claiming ITC Correctly, Get Practical GST Course in Delhi, 110080, by SLA Consultants India, New Delhi

Mar 24th, 2025 at 04:44 Learning Delhi 10 views Reference: 2679Location: Delhi

Price: Free Negotiable

Understanding GSTR-2B and its Role in Claiming ITC Correctly: A Practical GST Course by SLA Consultants India

GSTR-2B is an important document under the Goods and Services Tax (GST) regime in India that helps businesses claim Input Tax Credit (ITC) correctly. To fully comprehend its significance, it’s crucial to understand its structure and how it helps taxpayers ensure compliance.

What is GSTR-2B?

GSTR-2B is an auto-generated monthly statement issued to GST-registered taxpayers. It provides a consolidated summary of eligible ITC that a business can claim, based on the GST returns filed by its suppliers in GSTR-1. This document is pivotal because it allows businesses to verify whether they can claim ITC for a particular period and what amounts they are eligible for.

How GSTR-2B Helps in Claiming ITC Correctly

-

Auto-generated ITC Details: GSTR-2B is automatically generated by the GST portal based on data uploaded by suppliers through their GSTR-1 and GSTR-5 forms. This eliminates the possibility of manual errors in inputting ITC details, making the process more efficient and accurate.

-

Identification of Eligible ITC: GSTR-2B shows both the eligible and ineligible ITC for the period. It helps taxpayers distinguish between ITC they are entitled to claim and those they are not, based on factors such as mismatched invoices, non-compliance from the supplier, or documents not uploaded correctly.

-

Reconciliation of Data: The document serves as an essential tool for reconciling the inward supplies claimed by the business. GSTR-2B lists details of invoices and debit notes that suppliers have uploaded, helping businesses cross-check these with their own purchase records to ensure consistency.

-

Impact on ITC Claiming: A taxpayer can only claim ITC based on the details provided in GSTR-2B. If any discrepancy is found, the business can either reach out to the supplier to rectify the mistake or adjust the ITC claim accordingly. GSTR-2B ensures businesses do not claim more than they are entitled to, reducing the risk of penalties or audits.

-

Timely ITC Claims: GSTR-2B also assists businesses in ensuring they claim ITC on time. Since the statement is generated monthly, taxpayers can keep track of their eligible ITC, thus improving cash flow management by ensuring timely utilization of input credits.

-

GST Compliance: By accurately following the details in GSTR-2B, businesses ensure GST compliance and avoid penalties or interest due to excess ITC claims or incorrect filing. Proper use of this document aids in maintaining accurate records and ensures a transparent taxation process.

How GSTR-2B Helps in Claiming ITC Correctly, Get Practical GST Course in Delhi, 110080, by SLA Consultants India, New Delhi

Practical GST Course in Delhi by SLA Consultants India

SLA Consultants India, based in New Delhi (110080), offers a comprehensive Practical GST Course in Delhi that delves into all aspects of GST, including understanding and utilizing GSTR-2B for ITC claims. The course is designed for individuals and businesses looking to master GST concepts and ensure accurate filing.

This training covers:

-

Detailed Insights into GSTR-2B: The course provides hands-on learning of how to interpret and utilize GSTR-2B for correct ITC claims, ensuring businesses can stay compliant and avoid costly errors.

-

Practical GST Filing: Students will gain practical exposure to GST return filing, including how to reconcile GSTR-2B data with purchase invoices and ensure proper ITC claims.

-

Expert Guidance: Learners will be mentored by GST experts who provide in-depth knowledge and real-world case studies, helping businesses stay updated with the latest GST provisions.

By enrolling in SLA Consultants India’s course, individuals and businesses can equip themselves with the skills necessary to handle GST procedures efficiently, avoid tax-related issues, and make the most of available input tax credits.

In conclusion, GSTR-2B plays a crucial role in simplifying the process of claiming ITC by ensuring that businesses can verify eligible credits, maintain accurate records, and comply with GST regulations effectively. A Practical GST Course from SLA Consultants India can provide essential knowledge to make the most of this powerful tool in GST compliance.

SLA Consultants How GSTR-2B Helps in Claiming ITC Correctly, Get Practical GST Course in Delhi, 110080, by SLA Consultants India, New Delhi Details with "New Year Offer 2025" are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

GST Training Courses

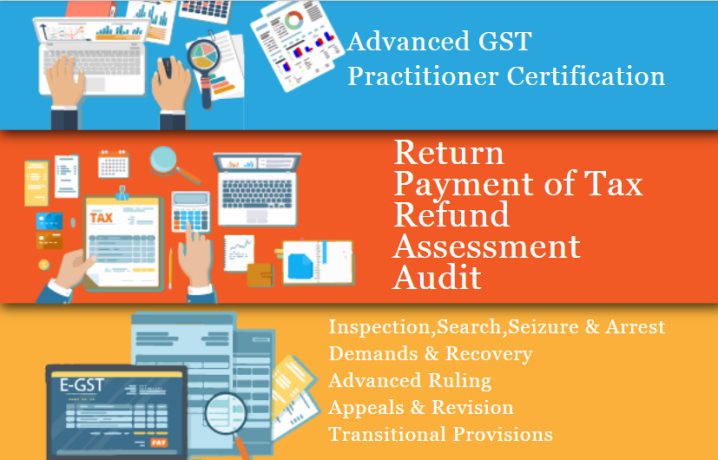

Module 1 - GST- Goods and Services Tax- By Chartered Accountant- (Indirect Tax)

Module 2 - Income Tax/TDS - By Chartered Accountant (Direct Tax)

Module 4 - Banking and Finance Instruments - By Chartered Accountant

Module 5 - Customs / Import and Export Procedures - By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi - 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/

![Best Data Analyst Course in Delhi, 110085. Best Online Live Data Analytics Course in Delhi NCR by IIT. [ 100% Job in MNC]](https://everclassified.com/storage/files/in/2082/thumb-320x240-50ad7aa8fe333ab64cd0b77309ad6ddd.png)

![SBI Business Analyst Training Course in Delhi, 110034 [100% Job, Update New Skill in '24] Microsoft Power BI by "SLA Consultants India" #1](https://everclassified.com/storage/files/in/990/thumb-320x240-b170563082eb05a32902c4c299f95453.png)

![Best Data Analyst Certification Course in Delhi, 110033. Best Online Live Data Analyst Training in Pune by IIT Faculty , [ 100% Job in MNC]](https://everclassified.com/storage/files/in/1671/thumb-320x240-4c8b9109523e97253630c448bf3bb204.png)

![ICICI Data Analytics Training Program in Delhi, [100% Job, Update New Skill in '24] Microsoft Power BI Certification](https://everclassified.com/storage/files/in/969/thumb-320x240-09eecedc3a69d58cc4b5494df26013cb.png)

![Genpact Data Analytics Training Program in Delhi, 110001 [100% Job, Update New Skill in '24] Microsoft Power BI Certification Institute in Gurgaon,](https://everclassified.com/storage/files/in/972/thumb-320x240-0e7cc07845fcd1d044537328e71fd4b8.png)

![Business Analyst Course in Delhi by Microsoft, Online Business Analytics Certification in Delhi by Google, [ 100% Job with MNC]](https://everclassified.com/storage/files/in/739/thumb-320x240-de4997b2e50902c3fb0ed04e813f4c9d.jpg)

![Deloitte Data Analyst Coaching Training in Delhi, 110022 [100% Job in MNC] Summer Offer 2024, Microsoft Power BI Certification](https://everclassified.com/storage/files/in/1362/thumb-320x240-a6a106efa8304d50808da41356096c6c.png)